All Categories

Featured

Table of Contents

Tax obligation liens in inadequate communities are additionally eye-catching for their speculative worth. For very little expense, tax lien financiers can declare liens on residential properties in locations where the marketplace has bottomed out in the hope that it will ultimately end up being targeted by developers and gentrifiers. In the meanwhile, their speculative financial investments commonly lie vacant and in disrepair, additional deteriorating community problems and blocking any kind of community-led attempts at revitalization.

Instead of reducing the underlying root causes of tax obligation delinquency among inadequate and minority homeowners and distressed communities, tax lien sales and the predacious industry they have spawned exacerbate them. It is well for these states to embrace a more humaneand extra effectivesystem for real estate tax enforcement. Simply ending tax lien sales is not sufficient.

We must, as a country, reinvest in our cities and towns and the vital public products and services they give. And we have to do so by tiring the tremendous and extremely focused riches of those on top, rather than exploiting those at the bottom. An earlier variation of this story marked Alden Global Funding as a hedge fund.

This has been remedied. We regret the mistake.

Tax Lien Investing California

Secret Takeaways Navigating the globe of realty investment can be intricate, however recognizing various financial investment possibilities, like, is well worth the job. If you're seeking to expand your portfolio, buying tax obligation liens could be a choice worth checking out. This overview is made to aid you understand the basics of the tax lien financial investment approach, leading you via its process and helping you make informed decisions.

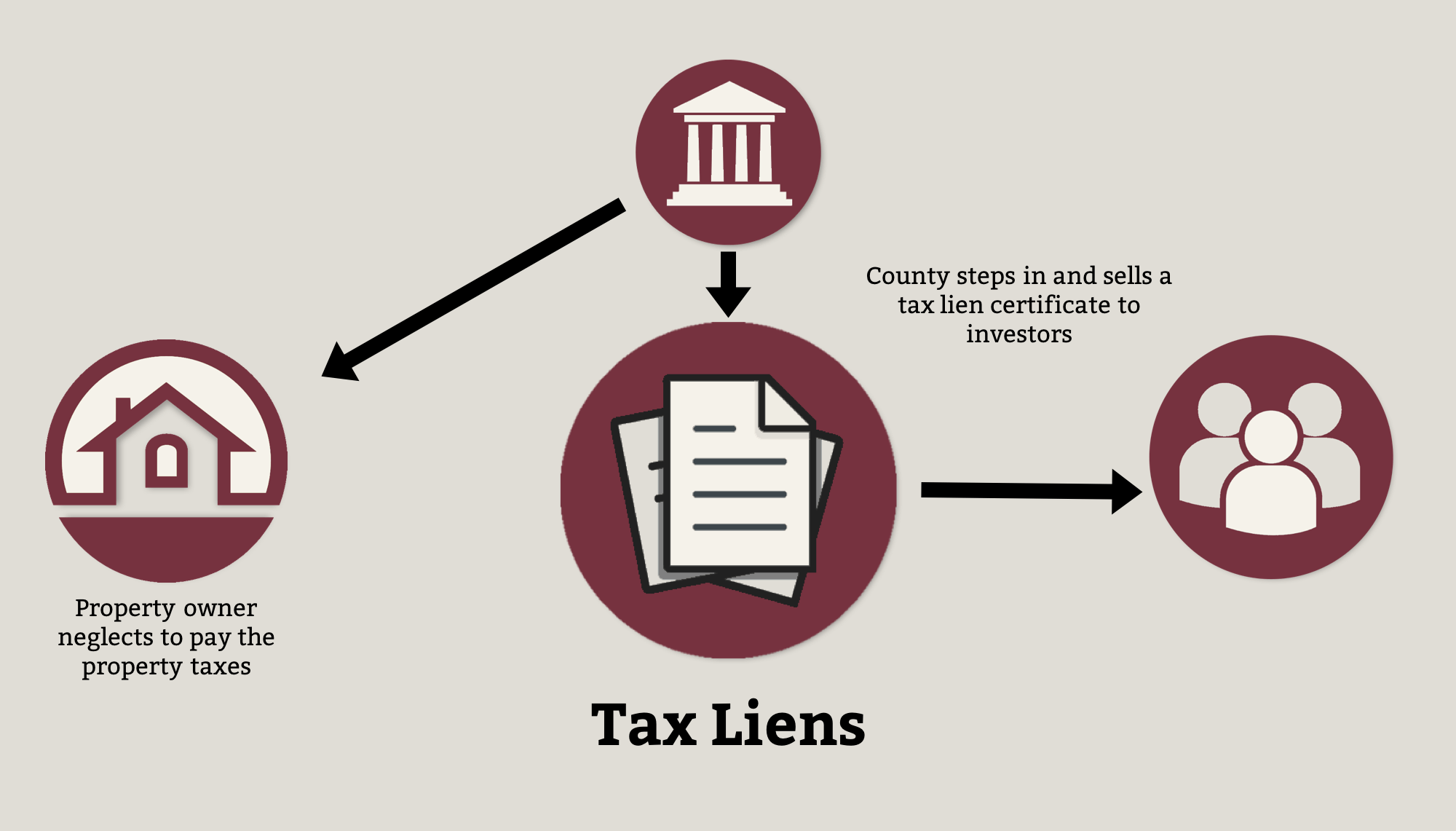

A tax obligation lien is a legal case enforced by a government entity on a property when the owner fails to pay building taxes. It's a means for the government to make certain that it accumulates the required tax earnings. investing in tax liens in texas. Tax liens are attached to the property, not the individual, indicating the lien remains with the property no matter possession modifications till the financial debt is gotten rid of

Tax obligation lien investing is a type of genuine estate investment that involves purchasing these liens from the federal government. When you invest in a tax obligation lien, you're basically paying somebody else's tax financial debt.

The local federal government after that places a lien on the home and may ultimately auction off these liens to investors. As an investor, you can buy these liens, paying the owed taxes. In return, you get the right to accumulate the tax obligation debt plus passion from the homeowner. This interest price can differ, yet it is typically greater than standard financial savings accounts or bonds, making tax lien spending potentially profitable.

It's necessary to thoroughly evaluate these before diving in. Tax obligation lien certification spending deals a much lower funding requirement when contrasted to other types of investingit's feasible to delve into this property class for as low as a couple hundred dollars. Among the most substantial attracts of tax lien investing is the potential for high returns.

Tax Lien Investing Crash Course

In many cases, if the homeowner fails to pay the tax financial debt, the capitalist might have the possibility to foreclose on the home. This can potentially cause getting a residential or commercial property at a portion of its market price. A tax lien commonly takes concern over other liens or home loans.

This is because, as the preliminary lien holder, you will certainly be needed to acquire any type of succeeding liens. (New tax obligation liens take precedence over old liens; depressing yet true.) Tax obligation lien spending involves navigating lawful procedures, specifically if foreclosure comes to be essential. This can be daunting and might require legal assistance. Redemption Periods: Building proprietors usually have a redemption period throughout which they can settle the tax financial obligation and passion.

Affordable Public auctions: Tax lien auctions can be very competitive, specifically for homes in preferable areas. This competitors can drive up prices and possibly lower general returns. [Understanding how to purchase property doesn't have to be tough! Our on-line real estate spending class has everything you require to reduce the knowing contour and begin buying realty in your area.

Certificate Investment Lien Tax

While these processes are not made complex, they can be shocking to brand-new financiers. If you are interested in getting going, assess the following actions to buying tax liens: Beginning by enlightening on your own concerning tax liens and how property auctions work. Recognizing the legal and economic intricacies of tax obligation lien investing is essential for success.

Not all homes with tax liens are excellent financial investments. When you've recognized possible homes, make a listing and prepare to bid at a tax obligation lien public auction.

After buying a tax obligation lien, you should alert the house owners. While similar, tax obligation liens and tax obligation actions have a various sale auction procedure.

When a person proposals and wins at a tax act auction, the tax obligation deed is moved to the winning prospective buyer, and they get ownership and rate of interest of the home. If the state has a redemption duration, the building proprietor can pay the overdue tax obligations on the building and retrieve their ownership.

Is Tax Lien Investing A Good Idea

Tax lien sales happen within 36 states, and 31 states permit tax obligation deed sales (some permit both). The specific acquiring process of these sales vary by region, so make certain to look into the policies of the area you are aiming to buy in before obtaining started. tax lien invest. Tax obligation lien investing offers a special opportunity for potentially high returns and residential or commercial property acquisition

Any type of party holding a Certification of Purchase (CP) on an overdue tax obligation lien for a previous tax obligation year might buy the overdue tax for a succeeding year. Succeeding year liens not sub-taxed will certainly most likely to the following tax lien auction in February. The interest earned on a sub-tax is the same as that of the initial CP.

Passion gets on the complete tax amount and accrues on the first day of each subsequent month. The fee for each sub-tax is $5.00. There are two methods to sub-tax: In the Treasurer's workplace making use of computer terminals situated in our entrance hall. Guidelines and aid are readily available. Send a list of preferred acquisitions and repayment to: Maricopa Area TreasurerAttention: Tax Lien Department301 W.

Parcel number(s) Certificate of Acquisition number Complete Amount of tax obligations & passion plus a $5.00 sub-tax fee per parcel Purchaser number Maricopa County Treasurer's Office recommends using EXCEL or one of the various other spread sheet programs when utilizing alternative 2. This will certainly increase the precision and timeliness of processing your demand.

Latest Posts

Investing In Tax Liens In Texas

What does Commercial Real Estate For Accredited Investors entail?

List Of Tax Lien Properties